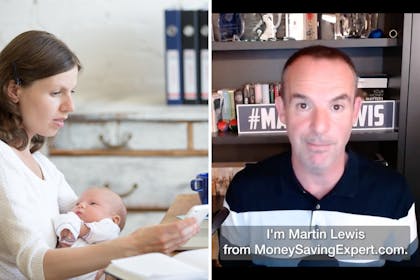

Martin Lewis' most-used trick to get back thousands of pounds

The Money Saving Expert said he's astounded by the amount of people this trick has helped claw back money

Martin Lewis has urged anyone who has ever taken out a student loan to check if they're eligible for hundreds, if not thousands, of pounds in cashback – as they may have overpaid.

The Money Saving Expert informed followers of his most-welcomed tip, saying he'd never had so many reports of success stories as he had with this one.

Martin's tip is for anyone who has ever taken out a student loan, regardless of the year you graduated and which repayment plan you are on.

'If you have left uni and have an outstanding loan this really is important to listen to,' Martin said.

- Families urged to apply for little-known DWP payment

- DWP issues third Cost of Living payment dates update

- How to FREEZE your debts

- What are Cold Weather payments and am I eligible?

- How to get FREE Lego this half term

- M&S £29 fleecy bedding set is like 'being cuddled by a friendly polar bear'

'Quick success reports'

It also doesn't matter if you did your degree in England, Wales, Scotland or Northern Ireland, though the criteria for claiming the money back does slightly differ between plans.

And the Money Saving Expert himself urged everyone who has ever had to repay a student loan to give this a try.

He stressed: 'I don't think I've ever had as many quick success reports for anything as I've had for this, so many "I got £xxx" successes coming in.'

'Some people can get thousands back'

Martin advised, through a video he posted to YouTube and Twitter, that anyone can give this a go.

He told viewers that a Freedom of Information request his team had put in 'showed over a million people overpaid in the 2022-2023 tax year'.

He explained: 'And that adds on top of millions who've overpaid in previous years.

'And as there's no back-date to how far back you can reclaim, there are a lot of people out there who may be due money.'

Only for those who've unwittingly overpaid and not those who've voluntarily overpaid, Martin talked through the process of how to get your money back and revealed: 'Some people can get thousands back.'

Why might I have overpaid?

Martin said there are 4 ways people may have overpaid.

He said the top reason someone might have overpaid was if they didn't meet the minimum threshold for repayments.

'833,000 people repaid [in the tax year 2022 - 2023] even though they don't earn enough to repay', Martin explained.

However, he clarified that the threshold for repayments depends on what year you graduated, where in the UK you did your degree, and which student loan plan you are on.

You can find out which student loan repayment plan you are on via the Government website.

Martin explained that the majority of people would be on either a Plan 1 or a Plan 2 repayment.

Those who are on a Plan 1 student loan will only start repaying once they earn over £22,015 a year, while anyone on a Plan 2 student loan will start repaying once they earn over £27,295 a year.

'Eligible to take that money back'

Taking 1 example, Martin explained that anyone who earns less than a total of £27,295, is on a Plan 2 loan and has repaid part of their student loan did not actually need to.

'So you are eligible to take that money back,' he said.

Another reason someone may have overpaid is if they were put on the wrong student loan repayment plan, he explained, and urged followers to check which plan they are on.

165,000 people were on the wrong student repayment plan during the last tax year, and had been defaulted to Plan 1 repayments, at a lower threshold.

Martin also advised that 57,000 people had had money deducted after their student loan was fully repaid and, while they'll be able to get this cash back, advised calling or applying online to be able to get a refund back quicker.

And, finally, he explained that 39,000 people in the last tax year had started repaying their student loans too early.

Most people, he added, were only eligible to start repaying in the April after they graduate and not sooner, but some slip through the cracks and start to repay it too quickly.

Should you claim the money back?

If you're unlikely to pay your loan back in full before it is wiped, then yes, you should claim your money back, said Martin.

He explained that this loan works in a different way to standard loans and only 20% of people are likely to pay their Plan 2 student loan back in full before it wipes, meaning most people would still have money remaining on their account at the end of the repayment period.

Martin clarified: 'In which case, unless you were going to make voluntary overpayments, for most people, the fact that you've overpaid won't actually reduce what you pay in future.

'So you don't get any benefit from overpaying.

'In which case, you may as well get that cash in your pocket now, cause it's not going to help you in the future.'

Other plans vary slightly and can be complicated, so Martin suggested checking other loan plans with the Money Saving Expert guide.

Will my student loan be wiped?

Whether or not your student loan will be wiped depends on which repayment plan you are on.

If you're on a Plan 1 repayment plan, your loan will be written off in the following circumstances:

- If you were paid the first loan before 1 September 2006 your loan will be written off when you're 65

- If you were paid the first loan on or after 1 September 2006 your loan will be written off 25 years after the April you were first due to repay

If you're on a Plan 2 repayment plan, your loan will be written off 30 years after the April you were first due to repay.

If you're on a Plan 4 repayment plan, your loan should be wiped out in the following circumstances:

- If you were paid the first loan before 1 August 2007 your loan will be written off when you're 65, or 30 years after the April you were first due to repay – whichever comes first.

- If you were paid the first loan on or after 1 August 2007 your loan will be written off 30 years after the April you were first due to repay

How to reclaim

Martin suggests gathering your old payslips, your payroll number and a PAYE reference number to take to the Student Loans Company.

You can then contact them online or over the phone with your details and tell them you think you've overpaid.

There is no time limit and, even if you don't have the documents mentioned above, it's still worth giving the helpline a call and asking them to check, as it could save you a whole heap of cash.

'Worth the phone call'

And while the amount of money people were able to get back differed widely, some took to X (formerly Twitter) to share how they'd managed to hundreds of pounds, to even £1,000 back.

'I claimed over £1,100 back earlier thanks to your advice. You are the best!,' said 1 happy customer.

'Thanks Martin wife rang and was entitled to £320 back amazing, thanks,' said a second.

And a third said it was definitely worth a phone call, saying: 'I got like £120 back which definitely comes into ‘worth the phone call’ territory, thanks Martin!,' he wrote.

Another added: 'I got £640, a friend got £360. Getting all my other pals to check too. Thank you Martin!'

Related stories

Every Cost of Living payment to come before Christmas

CHAT: tips and advice to help during the Cost of Living Crisis